GREEN & SUSTAINABLE BOND FUND (AUD)

SYNOPSIS

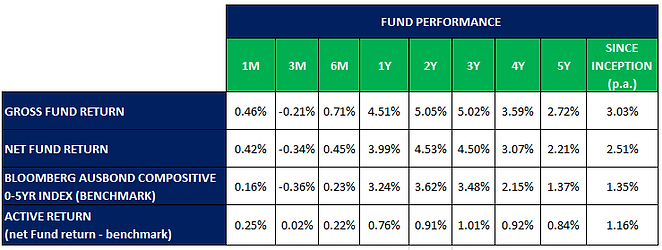

PERFORMANCE

RESEARCH

INVESTMENT PLATFORMS

OFFERING

DOCUMENTS

FUND

The Artesian Green & Sustainable Bond Fund will invest in a diversified portfolio of liquid, investment grade fixed and floating rate green, sustainable and social bonds. The Fund invests in Australasian and global issuers.

Additional Fund Benefits:

-

Using capital for a better future, not just a return

-

Same return as a regular or “brown” bond fund

-

Virtuous cycle of sustainable capital & job creation

-

Investment income from a positive, sustainable source

-

An additional source of risk management, excluding sectors more exposed to litigation and environmental issues

2024 achievements

In 2024 the Artesian Green & Sustainable Bond Fund has;

-

Won the Best New Ethical Fund 2024 at the Mindful Money Awards!

-

Upgraded to Recommended by Zenith!

-

Won the Australian Sustainability Fund Manager of the Year at the Kanganews Awards!

To watch the following "Meet the Manager Video" please acknowledge that you are either an AFSL holder or wholesale investor below.

STRATEGY

-

The Fund will invest in green, sustainable and social bonds issued by global companies and governments.

-

Investment grade fund with an emphasis on liquidity and credit quality.

-

ESG integrated investment research to provide optimal investment decisions.

-

Large global, experienced team of fixed income professionals trading and analysing credit markets 24 hours a day.

-

Providing investors a diversified exposure to a very hard to access asset class – green, sustainable and social bonds.

-

Excess returns are expected to be generated through a well constructed and actively managed portfolio in the global bond market.

2 PAGE SUMMARY

ONLINE APPLICATION FORM

Press the button below to complete an online application for an investment in the Artesian Green & Sustainable Bond Fund

2024 ENGAGEMENT SUMMARY

INVESTOR PORTAL

Artesian Green & Sustainable Bond Fund investors can login to the investor portal to access transaction history and unit pricing

TERMS

Target Return:

The Fund aims to outperform the benchmark (Bloomberg AusBond Composite 0-5 Yr Index) net of fees through active management.

Note the target return is not a forecast. It is merely an indication of what the Fund aims to achieve over the medium term on the assumption that credit markets remain relatively stable throughout the investment timeframe. The Fund may not be successful in meeting the benchmark return. Returns are not guaranteed.

Investment Management Fee:

0.30%

Administration fee:

0.20%

Minimum Investment:

AUD $25,000

Buy/Sell Spread:

0.10% / 0.10%

AUD UNITS

31 JANUARY 2026

RELATIVE PERFORMANCE

PERFORMANCE REPORT

JANUARY 2026

TARGET

MARKET

DETERMINATION

Product Disclosure Statement

Reference Guide

APPlication FORM

NZ Product Disclosure Statement

NZ Reference Guide

NZ APPlication FORM

TEAM

MORE INFORMATION

The Zenith Investment Partners (ABN 27 103 132 672, AFS Licence 226872) (“Zenith”) rating (ETL3604AU (Artesian Corporate Bond Fund) and ETL8782AU (Artesian Green & Sustainable Bond Fund) assigned June 2024) referred to in this piece is limited to “General Advice” (s766B Corporations Act 2001) for Wholesale clients only. This advice has been prepared without taking into account the objectives, financial situation or needs of any individual, including target markets of financial products, where applicable, and is subject to change at any time without prior notice. It is not a specific recommendation to purchase, sell or hold the relevant product(s). Investors should seek independent financial advice before making an investment decision and should consider the appropriateness of this advice in light of their own objectives, financial situation and needs. Investors should obtain a copy of, and consider the PDS or offer document before making any decision and refer to the full Zenith Product Assessment available on the Zenith website. Past performance is not an indication of future performance. Zenith usually charges the product issuer, fund manager or related party to conduct Product Assessments. Full details regarding Zenith’s methodology, ratings definitions and regulatory compliance are available on our Product Assessments and at Fund Research Regulatory Guidelines